Inflationary Impacts on Budgeting

- April 17, 2023

- Liz McDowell, Latest News, Insight, Featured, Finance

Since 2012, the Federal Reserve has targeted a 2% inflation rate for the US economy; however, recent inflation rates are currently hovering closer to 6%, after averaging 8% in 2022.

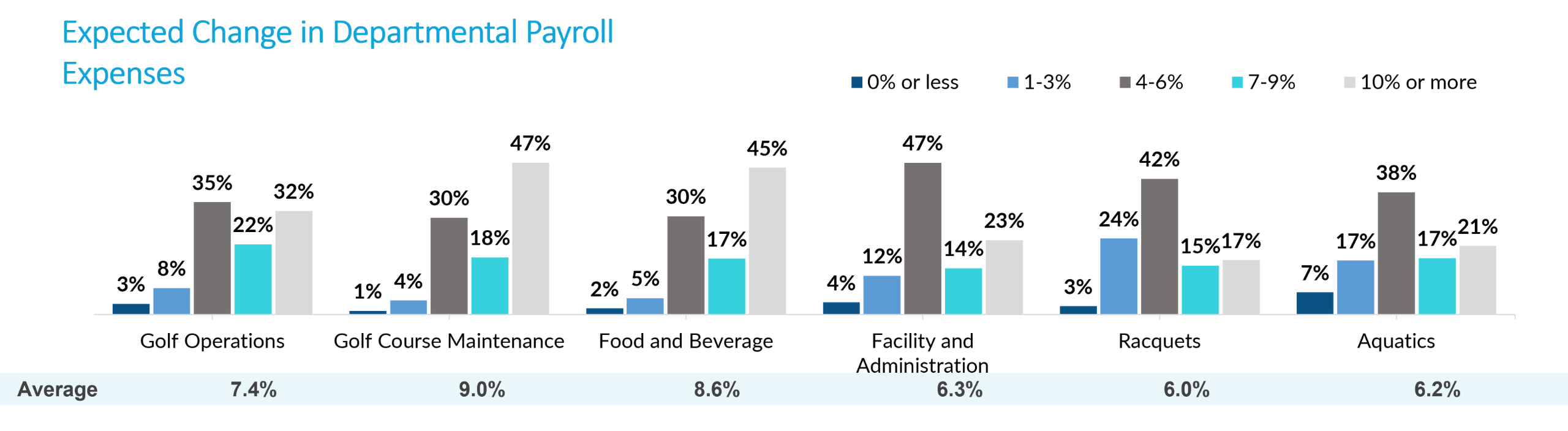

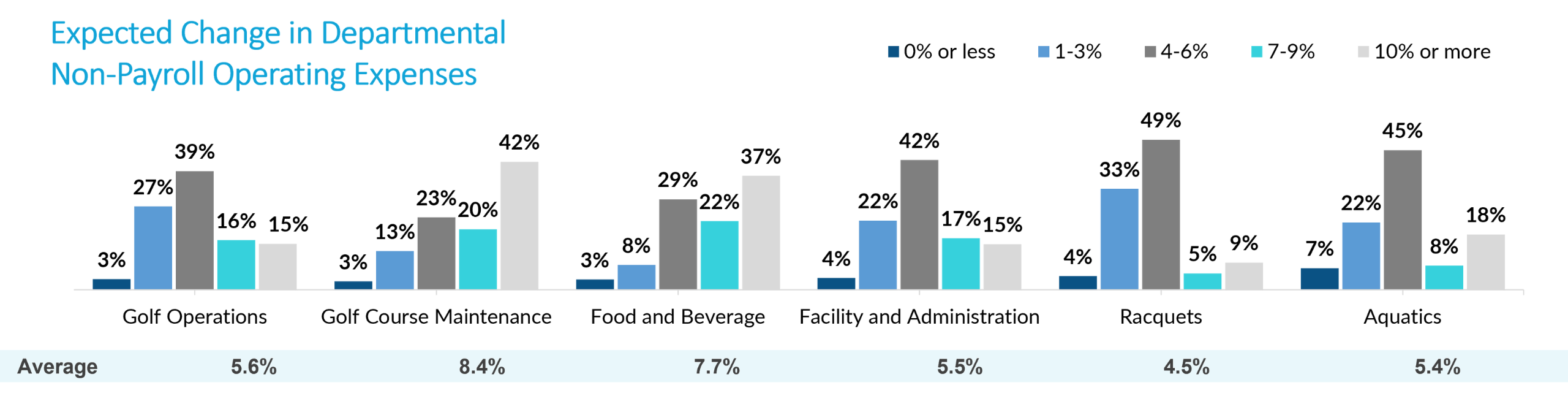

These ever-fluctuating inflationary rates are felt deeply in clubs, who are heavily impacted by increases to personnel costs as well as food and beverage and other key supply purchases. Club leaders are expecting continued high inflationary increases to key departmental expense budgets, including expected increases of 7.3% to payroll expenses and 6.2% to non-payroll expenses.

Unlike more traditional industries, where pricing strategies can be more nimble to reflect volatility in costs, clubs are generally bound to operate within the confines of an annual budget cycle, establishing member dues rates once a year and leaving limited flexibility to adapt or react as economic circumstances change within a given period. Clubs get one chance to get it right for the year, and live with the consequences of the assumptions and decisions made during budget-time.

Clubs can be best-prepared to addressing these inflationary challenges by being proactive with their budgeting strategy to validate the inputs, and ensuring that they have a robust communication plan in place to support the outputs.

Understanding the specific factors that will impact budgetary line items is the first step towards creating an effective budget, and the key factor that will impact your ability to clearly communicate any resulting pricing changes. Breaking down the specific inputs which have the most significant impact on overall membership dues, whether that be payroll, cost of goods, or other operating items, and getting a clear line of sight to the factors impacting their increases will allow you to budget effectively and provide an opportunity to communicate those reasons clearly, increasing the likelihood of membership acceptance of the changes. For instance, rather than applying a consistent inflationary rate across all line items, consider the specific regional and cost-specific information that will impact individual line items.

In line with the budget for the year, be sure to prepare a robust communication strategy to prepare members for the upcoming changes. Leverage external data points wherever possible to support the assumptions you are making, and ensure you highlight the wins wherever you can. As the cost of labor goes up, the relative cost of technology to replace that labor goes down. Consider opportunities to leverage technology to supplement / support (not replace) human capital and share that with your membership.

Whether investing in technology to supplement your variable workforce, altering your menu design to improve margin yields, or ensuring that your labor costs are keeping up with regional trends to secure your workforce for the longer-term, the more you can communicate with your membership, the more confidence you can have when it comes time to implement the impact of these changes via dues increases.

Rather than reducing service or programming offerings, the vast majority of clubs have responded to increasing costs by passing along these inflationary increases to their members. While inflationary pressures are certainly widespread, and members can be expected to be generally receptive to the idea of resulting cost increases, the more diligence that can be demonstrated by management throughout the budget process, the greater the membership buy-in is expected to be, and the less the membership resistance you can expect to hear.

Inflationary impacts are certainly being felt far and wide throughout the industry, and can make club budgeting challenging. Being proactive with your budgeting strategy, knowing how to respond to inflation, and communicating clearly and effectively with members can help to mitigate effects that result from inflation.

How GGA Partners can help your club address inflation

- Investigate ways to improve your cash flow.

- Explore ways to reduce your debt payments.

- Make suggestions to make your budget more inflation-proof.

Contact us today to discuss how we can help.