In ongoing research collaboration with Millennial golfer organization Nextgengolf, GGA recently updated its study of the habits, attitudes, and preferences of Millennial golfers. The 2019 study brings forward survey findings from over 1,400 Millennial golfers and builds upon research conducted in 2017 and 2018.

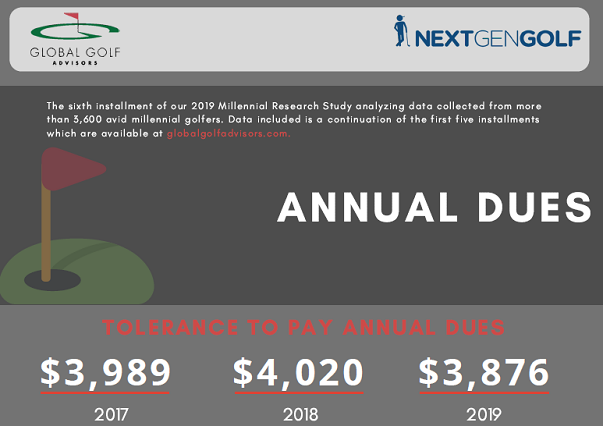

This is the sixth installment of a multi-part series of infographics to feature the latest Millennial golfer feedback. Part 6, below, examines the tolerance levels of Millennial golfers to pay annual club dues and considers these within the context of what inhibits or triggers them to join private clubs. Also included are some suggestions from Millennials on how clubs can increase the relevance of their dues structures to the Millennial audience.

See previous installments here: Part 1, Part 2, Part 3, Part 4, Part 5 and look for new installments to be released in the coming weeks.

Loading...

Loading...

Research Overview

In many clubs today, the long-held expectations and perceptions of existing, ageing members are at odds with the entirely different needs and expectations of a new wave of younger, more casual members. The challenge for clubs? To create an environment which not only appeals to the new wave, but where members of all types can coexist.

Research findings highlight how golf clubs can adapt and develop their offerings to meet the needs of the next generation of members and customers. The goal is to provide valuable insights about Millennial golfers, the challenges they face, and the opportunities for clubs to help support the long-term sustainability of the game and the industry as a whole.

Background

As the leading entity for team-based golf in the United States, Nextgengolf connects Millennials to golf and supports the success of their game while GGA specializes in solution engineering and problem solving for golf-related businesses. A fusion of GGA’s 27-year history of private club research and Nextgengolf’s connection to young golfers afforded the unique opportunity to study a highly valuable Millennial audience.

The survey sample focused exclusively on a sample audience of active, avid Millennial golfers with prior golf interest and experience in tournaments or golf events. To date, more than 3,600 survey responses have been analyzed during the three-year research study.

Thank you to the Club Management Association of America (CMAA) for the support that makes this research possible.