Findings from 6th Annual Research Study on Generational Golfers

Generation X, Millennials and Gen Z, with their own attitudes, behaviors and perspectives, have redefined the future of golf.

In brief:

- New research into family habits of U.S. golfers has uncovered data in how three generations view family dynamics, play, skills and learning, expenditures and their general satisfaction with the sport.

- Industry survey of over 1,500 golfers whose average age was 30 years old highlights how the presence of children and partners, and generational membership, directly impact the expectations, behaviors and priorities of golfers.

- The report explores the overarching similarities and differences between Generation X, Y (millennials) and Z, and their family structures, and what this data means for the future of golf.

GGA Partners, The National Collegiate Club Golf Association (NCCGA), and The City Tour have released a study entitled, “Beyond Millennials: New Generations and the Influence of Family.”

It is no secret that golf’s popularity has exploded as a result of COVID-19. In 2020 and 2021, golf was one of the activities least likely to contribute to the spread of COVID-19 as it is played outside where one can keep their distance from others. In our 2021 Industry Survey, 60% of respondents indicated that golf has become more important in their life because of the COVID-19 pandemic. In 2022, that number decreased slightly to 53%, but it is clear that the elevated interest in golf has somewhat sustained, even as the threat and related restrictions have diminished. While the pandemic has increased interest in the sport, new challenges are placing additional pressures and impacts on golfers.

With this in mind, here are three key insights from this year’s research:

Millennials play significantly less golf than Gen X and Gen Z. Interestingly, singles played slightly more golf than partnered respondents, and players who were widowed, separated or divorced are playing the most golf within the group.

Gen Z are more likely to play with family than Gen X, while Millennials showcase a tendency to play more with friends than the other two cohorts. Generation X played with fellow members at a much higher rate, while Generation Z showed lower than expected interest in playing with members.

Gen Z golfers spend the least on both greens’ fees and extra spending at the course, while Millennials show the most interest in spending the most on greens fees. Gen X will spend the most while at the course.

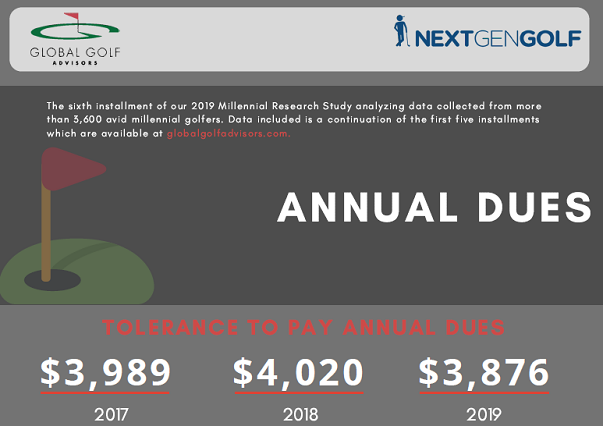

Two thirds of survey respondents indicated they would be willing to spend more – with 50% of respondents indicating a range of up to $5,000 – to join a private club. Gen X was willing to spend more ($6,758 USD) as compared to both Gen Z and Millennials, who indicated they were willing to spend slightly less ($6,100 USD). Widowed/divorce respondents are willing to spend the most ($6,818 USD) with singles willing to spend the least ($6,022 USD).

Access the full report now for further detailed insights.

Download report

For further information, contact:

Dr. Eric Brey, Ph.D

Director, GGA Institute

t: 715.505.7716

e: eric.brey@ggapartners.com