Earlier this year Global Golf Advisors, in conjunction with Nextgengolf, released a follow up report to its ground-breaking 2017 study entitled ‘The Truth About Millennial Golfers’. GGA’s Michael Gregory, backed by the findings of the research, gives a Millennial’s take on what clubs need to do next to realize the clear opportunity this group presents…

We run the risk of a two-tier club membership model emerging. One where the long-held expectations and perceptions of existing, ageing members are at odds with the entirely different needs and expectations of a new wave of younger, more casual members.

The challenge for clubs? To create an environment which not only appeals to the new wave, but where members, of all types, can co-exist. For some club decision-makers this may be a source of discomfort, because enacting a change that leans one way or the other could potentially upset or alienate the other group.

From my experience, however, it’s clubs who resist change entirely that do themselves a disservice; sub-consciously siding with a diminishing number of older members, which, over time, makes their membership product less appealing to younger prospects.

Now, being a Millennial, it would be natural or somewhat biased having conducted this research to declare that clubs need to change their value proposition for a younger audience, and that their survival depends on it. But while there is truth in this, clubs can and should choose to see this as an opportunity – it’s real, it’s there to be seized, and at some point (whether now or in the future) everyone will need to appeal to this new wave.

Seeing things from a Millennial’s perspective

To help you on this journey, I’d like you to see the following as an insight into what Millennials think and feel about the prospect of joining your club. Each of the findings can provide the fuel for you to create a genuinely appealing product to this (potentially) lucrative group.

Millennials want flexible, scalable membership aligned to how they will utilize the club

Think about what’s important in the life of a Millennial: work, health and fitness, family, friends – all of which impact on free leisure time.

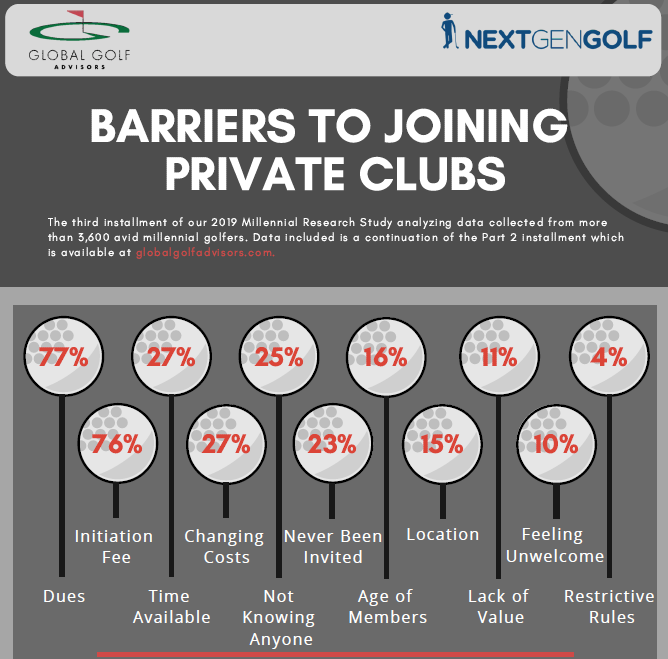

With such time and (in some cases) financial commitments already in place, a high-ticket membership subscription and entrance fee will not only be unappealing, it won’t even be on the radar.

51% of Millennial survey respondents stated their preference is a flexible membership with a low social fee that provides full access, with golf on a pay-per-use basis. Understandable when you look outside the four walls and find other leisure amenities and gyms offering ‘Build Your Membership’ options.

So, rightly or wrongly, Millennials prefer to customize and take an ‘á la carte’ approach, experience the product first (do you offer a membership trial?) and have confidence in the commitment they are about to make.

While this might sound like a ‘cake and eat it’ mentality, think about the lifetime value of these customers; if you can be flexible and deliver an outstanding experience from the outset, the likelihood is they will stay with you for years to come.

Millennials would prefer to pay a higher annual fee over an entrance fee

Not only is the financial impact of an entrance fee off-putting, no matter how many years it can be spaced over, but Millennials also aren’t keen to commit or have a sense of being ‘tied-in’. Especially in cases where they are uncertain how much they will get to access the club (because of time constraints and family/work commitments).

This doesn’t mean to say Millennials will be looking to leave or switch clubs shortly after they join. They would simply rather not outlay a large financial sum at a time of life when, away from the golf course, they often have other life events and variable expenses (home-buying, weddings, children) to keep in mind.

The upshot – Millennials are receptive to a higher subscription fee, appreciating that greater flexibility should come at some cost to them.

Millennials want more than just golf

From the research, we learned that 33 was the mostly likely age for Millennials to join – the ‘sweetspot’. A time at which Millennials, when considering membership, are also looking for fitness (71% of respondents), family access (65%) and a swimming pool (62%). Whether these facilities carry an additional, pay-per-use fee is at a club’s discretion, but simply the provision of such amenities can be a significant draw for a Millennial audience.

Something to bear in mind here: the provision of these amenities will help to boost the dwell time of Millennial members. So, when paired with our other findings in relation to how new Millennials join a club (83% through recommendations from friends, family or colleagues) it stands to reason that the more a club becomes a part of someone’s routine or lifestyle, the more chance of them recommending membership to others.

A watershed moment

When we embarked on this research with Nextgengolf, we did so with the ambition to grow the game and give the gift of golf. What’s clear from working with club managers globally is that, actually, this is an ambition we all share.

Whether this is a watershed moment which helps you to rethink and act on how to connect with a Millennial audience is up to you. But from my, perhaps somewhat biased opinion, the ability for your club to shift gear and develop a genuinely compelling product offering to this group could help unlock those long-term members you are looking for – the ones who will form the future nucleus of your club.

Read the 2018 ‘Truth About Millennial Golfers’ Report

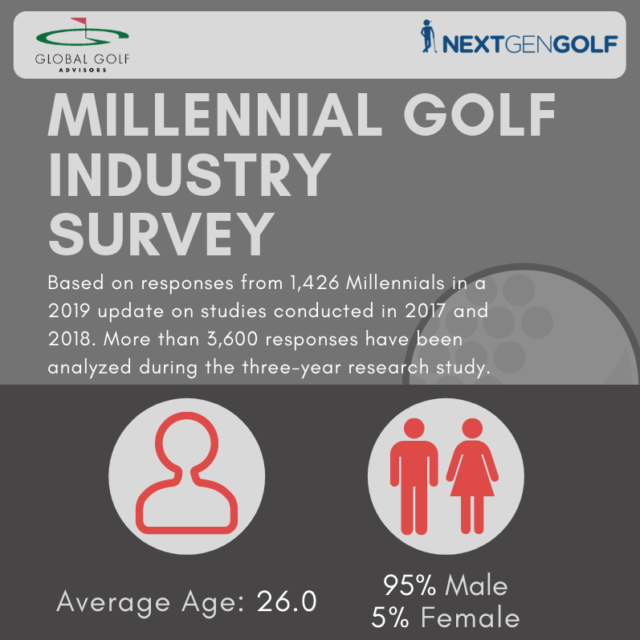

Note: The survey sample for the Truth About Millennial Golfers study focused exclusively on a sample audience of active, avid Millennial golfers with prior golf interest and experience in tournaments of golf events.

This article was authored by GGA Senior Manager and Market Intelligence expert Michael Gregory.

Loading...

Loading...