When was the last time you conducted a thorough review into your membership categories?

GGA’s Bennett DeLozier explains how a streamlining process can help to slim down the number of categories and keep them relevant in today’s marketplace.

“Confusion and clutter are failures of design, not attributes of information” – Edward Tufte

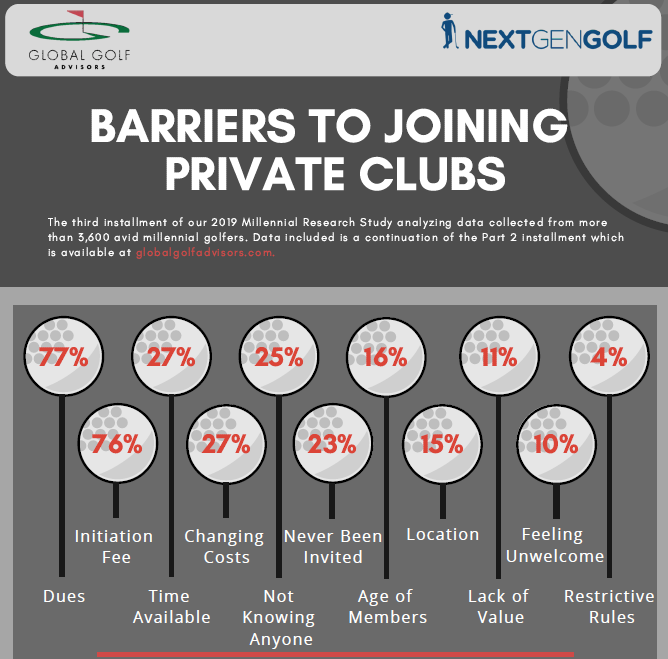

Across North America and Europe a competitive landscape for membership has emerged, with more leisure pursuits competing with one another than ever.

Naturally, club leaders across the world are not sitting back and watching the evolution of customer needs and wants without acting. But while a great deal of this action is well-placed – from the introduction of intermediate and family memberships in North America to flexible membership schemes in Europe – in other instances it is leading to an uninformed inflation of membership categories, creating confusion for customers and an administrative headache for club leaders.

A trail of memberships

It is common for categories to emerge at a particular point in time, often as a reaction to an event, as an attempt to appease a vocal minority, or in an effort to attract a specific new member cohort.

Many clubs react to changes in the market by adding or creating a new membership category to appeal to specific segments. When structured properly, this can be an effective way to cast a wider net and appeal to different audiences. However, when this happens in an unstructured way over a number of years, a club may end up administering upwards of 15 to 20 categories at a time.

More categories mean more discounting, different access, and different privileges. Membership samples per category get smaller, and it becomes too much to administer and too confusing for existing and prospective members alike.

Top-performing clubs have fewer membership categories, largely because they enjoy demand such that members are attracted to them versus the other way around. For others, what should be a set of simple, straightforward membership categories becomes a patchwork quilt, absent of any tangible strategy or current solution to underpin its creation.

Naturally, tackling this issue has its challenges. How do you begin to evaluate and streamline so many categories? How do you negotiate shifting members from one category to another?

Streamlining your categories

Current market intelligence and supporting research is essential to guide this process. Once you understand the current market circumstances and positioning of your club, you can identify where membership categories may need to be realigned to attract future members.

The key is to study internal membership utilization rigorously so you can understand where your club has the capacity to grow. The adjustment of existing categories or development of new ones should be based on creating access and privileges in areas where the club has room to grow, not necessarily where prospective members desire it.

To illustrate the importance of proportionate categories, think about one which has emerged in recent years particularly: the intermediate or young professional category.

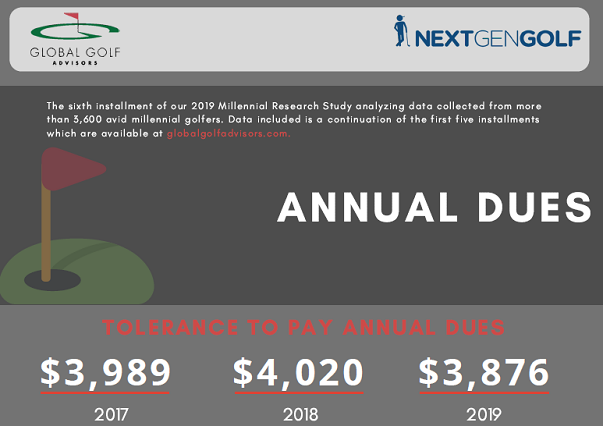

Typically offered to those between the ages of 25-35 (with a great deal of variance depending on the club and location), its origins are rooted in the issue of affordability both in dues and initiation fees. This has given way to lower dues, waived initiation fees, or a tiered system based on a particular age bracket.

While the introduction of such a category has been, in most cases, an appropriate tactic, it is one in need of constant analysis. As young intermediate members age into their mid-thirties their lifestyles begin to evolve, so does what they need, want and expect from their club experience.

This poses a challenge to clubs: do you change the existing intermediate category or create a new one to meet evolving demands?

The answer comes back to robust intelligence – intelligence which enables club leaders to get ahead of this challenge long before it makes its way to the doorstep. Intelligence allows you to measure and monitor utilization, enabling category adjustments which match lifestyle changes and market trends.

Moving members

Whether you’re dealing with category overload, wrangling legacy categories that you are looking to streamline, or have members moving up an age category where there are implications to their dues or privileges, at a certain point in time it is necessary to change.

But it’s difficult to change members from one category to another.

Legacy categories can be contentious, as members are unlikely to welcome category change – especially if this means an increase in dues. Club leaders should enter the process with the primary aim of growing where the club has the capacity to grow and a secondary aim of establishing a fair playing field across the membership base.

The best practice approach is to identify categories that have become irrelevant and essentially ‘grandfather’ those members into new categories which fit the room-to-grow bill, allowing them the opportunity to transition into new categories under advantageous terms.

If we look back to our young professional categories, when the time comes for them to move up the ranks to full membership, invest time and attention into the process. Why? Because these members have reached a pinch point, a ‘fight or flight’ moment in their membership tenure. If they decide to progress through to full membership now, the likelihood that they will stay for the long-term increases substantially.

Communicating your product

Before communicating your streamlined categories, club leaders should have answers to the following: Are the current categories relevant? Are they performing financially? Are category offerings causing issues with facility accessibility or compaction of activities? How do they situate within the local market and relative to competitor offerings? What benefits will category changes provide existing members? What benefits will they provide the club?

Once in position to communicate the changes internally, preempt what members will think. The primary concern for them will be, naturally, “How does this impact me?”. But the club’s agenda should also form part of the equation. Communicate how the changes will make the club more attractive to future generations and how they will support the club’s financial sustainability. Although it may feel self-serving, it will help to mitigate any ill-feeling among members by giving clarity and a sense of purpose to the changes.

For the change itself, successful clubs provide the option to transition into a new category that has similar access under favorable terms (such as a lateral move into a new category at no cost; or, upgrading to a higher privilege category at a lower incremental entrance fee compared to that of a new member off the street).

Externally, the focus should be on competitive advantage through value. It’s easy to compete with local competitors on price, but it’s not necessarily advantageous to the club. The best clubs look at ways to establish their competitive advantages by adding new programming and subtle category elements that make the value proposition more attractive. Injecting value is preferable to cutting costs.

Clarity over confusion

A proactive and streamlined approach to membership categories has much to offer: an easy-to-manage administrative process and clarity for existing members, prospective members and the Board.

A review of your membership categories also offers the opportunity to view each through the lens of the future and under the guidance of current research. With membership dues representing a hugely significant revenue component for any club, this process is time well spent.

For guidance on how to revise your club’s membership categories, connect with

Bennett DeLozier.

Loading...

Loading...