New members can be difficult to come by, especially during times of economic turbulence. But your existing core membership can hold the key to unlocking a wave of new members. GGA’s Michael Gregory explains how.

Why are your current members a valuable avenue for new members?

Members who have developed an emotional connection with your club will be proud to show it off to friends and peers. Friends and peers who will typically be of a similar income bracket, age and family profile.

Since the club’s membership proposition already appeals to those existing members, its relevance to their friends and peers is naturally much higher than it would be for a typical prospect.

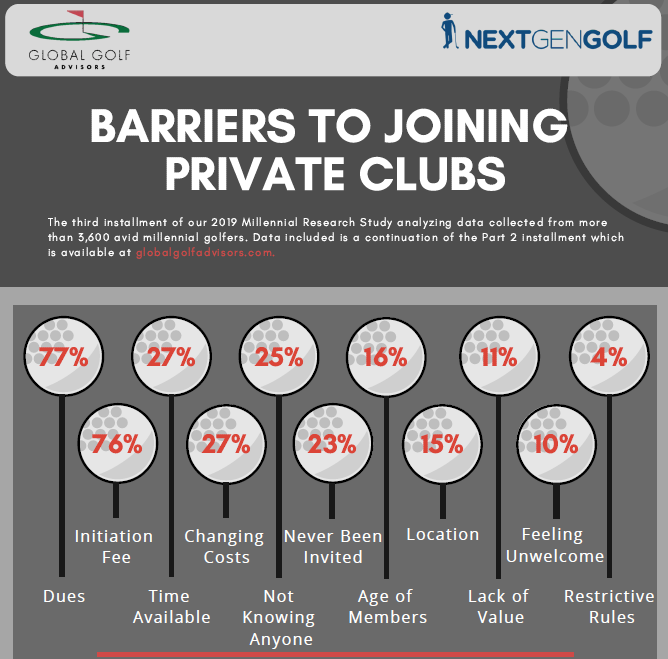

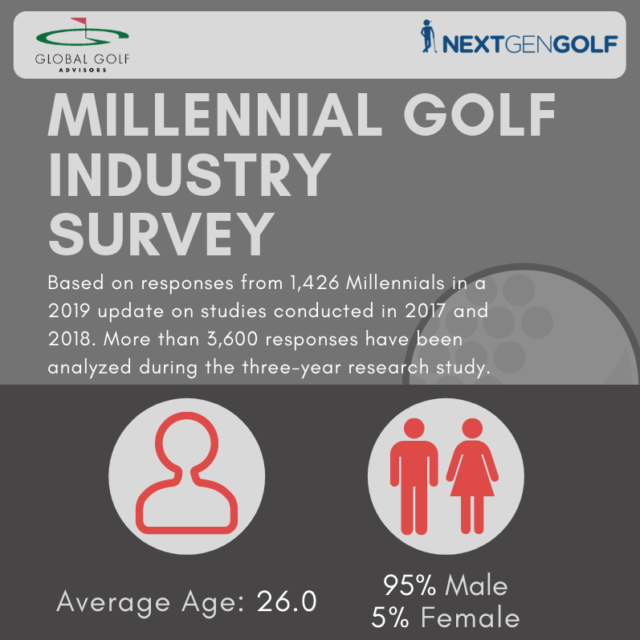

Add in our findings; surveys of over 50,000 private club members each year reveal that ‘friends and family who are members’ is consistently one of the top three factors in the decision to join. For millennials, it’s even more important. All of a sudden, the importance of existing members comes into focus.

But what is it that gets these prospects over the line?

Ordinarily, a club employee will be the one selling the benefits of membership to prospects. In this case, however, its existing members. They’ll be your best advocates, your best sales men and women. They can express what it means to be a member, told through the eyes of the members themselves. A compelling and convincing message, and an effective mechanism to generate new members.

Should there be an official referral scheme in place to incentivize current members?

Before developing a formal or informal scheme you should scrutinize the current numbers. How many member referral leads do you generate? In our experience, over half of member leads usually come from referrals. If your number is far lower, you first need to ask why.

A member satisfaction survey can provide the answers. If satisfaction is low in areas central to your club’s value proposition, then existing members will not be as forthcoming in promoting the club to their friends and peers.

After your survey, isolate the areas in need of improvement and build these into your strategic plan. With the root causes of dissatisfaction being addressed, the club will organically become somewhere that members have a stronger connection with, and in turn a place they are more likely to recommend to potential new members.

It’s true that a catalyst may still be required to supplement this process and to help overturn a culture of non-referral. But a word of caution on this: a referral scheme should not be rolled out as a short-term solution to get more members. It could come across as desperate, distorting the value perception of membership at your club, and you could give too much away if not carefully developed.

We have found that recognition can be just as motivating as monetary incentives. So, before opting for the financial route, give some recognition to those who have referred members in a given month or year (which could be as simple as acknowledging the individuals in the club newsletter), then see if this spurs on more to act.

Is there something else club managers should be doing to ‘activate’ their members?

A lack of satisfaction can be one cause of low member referral numbers, but it might be as simple as not having created the opportunities for referrals to happen.

The good news is there are some simple and effective tactics you can roll out to create a fertile referral environment:

Golf days – the most obvious but often overlooked. Open days, invitation days and corporate days are a great way for prospects to experience what the club has to offer and provide the opportunity to spend some quality time on the course with other members.

Social events – allow members to invite guests along to select social events. It will introduce them to the club environment, they’ll get to meet other members and begin to feel what it’s like to be part of the membership community.

Crucially, welcome families along to these events too. We know how important spouses can be in the decision to join a club, so they need to get a first-hand look at how membership could enrich their life.

Discovery days – host a discovery day for existing members to bring along selected guests. Put together a dedicated itinerary where prospects can experience what it’s like to be a member, and give them the opportunity to join at the end of it.

Membership toolkit – arm your members with a “membership tool kit”. This can provide them with clear guidance on what to do should any of their friends or relatives want to visit or even join the club.

Is it all a numbers game?

The thing to remember is, a typical club’s attrition rate stands at around 20-35 members. With conversion rates between 8-12%, that means a club will need at least 200 prospects on any given year just to replace what they lose.

So the numbers are important. Your current members should be your most important pipeline for new members, and if less than half of your prospects come from your existing members, it’s time to pay attention and act. Your future depends on it.