GGA Partners Continues Thought Leadership Series with Four New Whitepapers

‘The New Urgency of Strategic Planning’ Now Available for Download

TORONTO (June 10, 2020) – GGA Partners – international consulting firm and trusted advisor to many of the world’s most successful golf courses, private clubs, resorts, and residential communities – will continue its thought leadership series with the publication of four new whitepapers to help leaders of golf, club, and leisure businesses make better-informed decisions regarding key planning and marketing challenges. The whitepapers focus on strategic planning, branding, governance, and innovation.

Let’s Face It, Times Are Changing

That may be the understatement of the year.

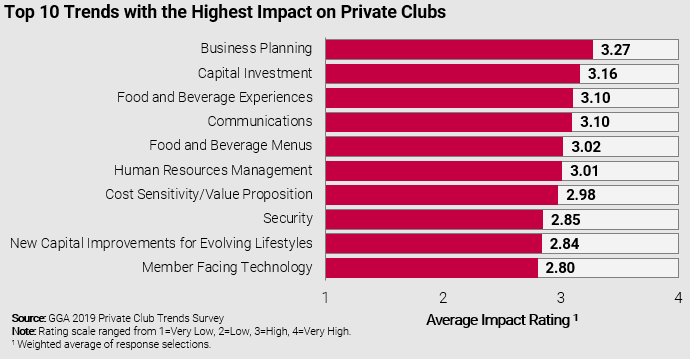

Between rapidly advancing technology, economic uncertainty, transforming demographic and lifestyle stressors, and a digitally-connected global community, the environment for club and leisure-related businesses is more competitive than ever.

The business landscape is shifting and management stances are evolving, yet the principles of competition endure: one’s gain is another’s loss and the strongest will come out on top.

Knowledge is a tremendous source of strength and GGA Partners is developing authoritative reports on the industry’s most pressing issues and constructing advanced problem-solving guides for the road ahead.

The New Urgency of Strategic Planning

The strategic planning whitepaper, which can now be downloaded from the GGA Partners website, focuses on a misconception regarding the strategic planning process, according to Henry DeLozier, who along with GGA partners Steve Johnston, Rob Hill, Derek Johnston, and Michael Gregory authored the paper.

“Because of its traditional long-range horizons, many club leaders don’t prioritize strategic planning,” DeLozier said. “With conditions inside and outside the club environment changing as quickly as they are, there’s a new urgency to strategic planning.”

In addition, the whitepaper argues for a shorter planning cycle, ranging anywhere from 12 to 24 months, and a closer connection between strategy and execution.

“Businesses that are directly affected by shifts in the economy and consumer preferences should consider shorter planning cycles,” Johnston said. “Think about it: Would a five-year strategic plan created in 2015 successfully guide your business today?”

Today’s most successful clubs look at their strategic plan as a blueprint for action, Hill added. “They don’t put their plans on a shelf to gather dust. They’re implementing their plans, adjusting as needed and executing their vision for the club.”

For club managers not familiar with the strategic planning process, the whitepaper explains five key steps in developing a plan and draws on examples from inside and outside the private club business.

In addition to strategic planning, other whitepapers in the series focused on branding, governance, and innovation will be published through the third quarter of 2020. Discover more about the cross-section of high-impact topics GGA Partners is studying at ggapartners.com.

Click here to download the whitepaper

About GGA Partners

GGA Partners™ is an international consulting firm and trusted advisor to many of the world’s most successful golf courses, private clubs, resorts, and residential communities. We are dedicated to helping owners, asset managers, club and community leaders, investors and real estate developers tackle challenges, achieve objectives, and maximize asset performance.

Established in 1992 as the KPMG Golf Industry Practice, our global team of experienced professionals leverage in-depth business intelligence and proprietary global data to deliver impactful strategic solutions and lasting success. For more information, visit ggapartners.com.

Media Contact:

Bennett DeLozier

GGA Partners

602-614-2100

bennett.delozier@ggapartners.com